EXPLAINER | Breaking down government’s ‘R800bn’ economic stimulus package

The combined fiscal and monetary package to bolster the economy as we battle Covid-19 is estimated to be more than R800 billion. But where will this money come from, and has it been paid out yet?

More details will likely be revealed once Finance Minister Tito Mboweni tables the adjusted budget before Parliament. Treasury plans to be ready to table the budget by 24 June.

The SA economy, in the meantime, is reeling from the devastating effects of the lockdown, which was instituted just over seven weeks ago to slow the spread of Covid-19. Treasury projects the economy to contract as much as 16.1{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}, and more than seven million jobs to be lost, as a worst-case scenario.

Businesses are also reporting lower turnover and are increasingly having to lay off staff, data from Statistics South Africa shows. A Nedbank survey showed that nearly 70{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} of small businesses were unable to operate during the initial five-week lockdown, Fin24 reported.

But government has been steadfast about taking a risk-adjusted approach to reopen parts of the economy, so as not to have an influx of Covid-19 infections which overwhelm the health system.

Government has endeavoured to strengthen the “economic safety net” to support households and businesses during this difficult time. While Treasury has developed a fiscal package worth R500 billion, the Reserve Bank has also taken steps to support the financial system, bringing the total stimulus to R800 billion, Finance Minister Tito Mboweni previously said.

“Our combined fiscal and monetary policy package is over R800 billion. This is a major fiscal and monetary policy response,” Mboweni said.

Fiscal response

According to Mboweni, the fiscal package allows for spending on healthcare and “other frontline services” to be increased by R20 billion immediately. This will support treatment of those affected by the virus, testing and contact tracing and the procurement of personal protective equipment.

Government also intends to expand financial support through existing social programmes, to support low-income households. A total of R50 billion will be made available to top up social grants and provide social relief for six months. From May, beneficiaries of child grants receive an additional R300. From June, caregivers will receive an additional R500 each. All other grants are to be topped up with an additional R250 per month for six months. A separate Covid-19 social relief of distress grant of R350 has been established and will be paid out for the next six months to those who are not employees and do not receive social grants or a UIF benefit.

President Cyril Ramaphosa, at a briefing on Wednesday night, confirmed that so far three million South Africans had applied for the Covid-19 grant, Fin24 reported. Since the beginning of May, government has paid out an additional R5 billion to social grant recipients.

A total of R40 billion will be provided from the UIF, for employers to apply on behalf of their employees for financial support. Ramaphosa said that over R11 billion had been paid from the UIF Covid-19 relief scheme so far to employees from over 160 000 companies in distress.

A loan guarantee scheme – in partnership with major banks (including Absa, Investec and FNB and Standard Bank), National Treasury and the South African Reserve Bank – was established to help companies. This will not have immediate fiscal implications, according to Treasury.

The scheme officially launched on Tuesday, 12 May, and is made to assist businesses with turnover of less than R300 million, to help them meet their operational expenses. Treasury has provided a guarantee of R100 billion, initially, and there is an option to increase the guarantee to R200 billion if necessary and if the scheme is considered successful.

Government has also set aside R100 billion to support small businesses. Various funds have been established by several government departments – small business development, tourism, and the Industrial Development Corporation. These funds as well as the South African Future Trust established by the Oppenheimer family has provided assistance to over 27 000 enterprises so far.

Meanwhile, a total of R20 billion is set aside to support municipalities. Treasury announced on Tuesday that more than R5 billion was made available for municipalities to provide basic services such as the provision of water and sanitation to vulnerable communities during lockdown, and to sanitise public transport facilities.

“The largest amounts have been made available through the reallocation of conditional grant funds already allocated to municipalities in 2019/20,” Treasury said. Furthermore, Treasury has allowed funds transferred to municipalities, but which are not contractually committed, to be reallocated to responses to the Covid-19 pandemic.

A set of tax relief measures amounting to R70 billion also forms part of the package. This includes deferral of tax payments on excise duties, carbon tax, and employee’s tax. Government has postponed some corporate tax proposals, outlined in the national budget. SARS will also fast-track VAT refunds. Donations to the Solidarity Fund, set up to support the vulnerable, will also be tax deductible.

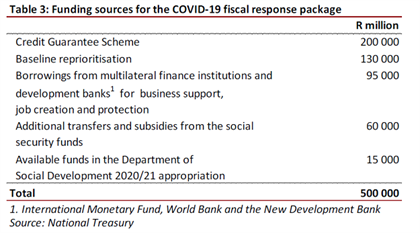

Sources of the funding for the R500 billion fiscal package include a reprioritisation of R130 billion from the existing budget. Government is in talks with multilateral institutions such as the World Bank, the IMF and New Development Bank to secure R95 billion in funding, while about R15 billion is earmarked from the department of social development appropriation for 2020/21.

Monetary policy response

The balance would come from monetary policy measures, according to Treasury. “The South African Reserve Bank (SARB) estimates that the monetary and financial sector policy elements of the package of measures will inject more than R300 billion into the economy. This takes the total combined fiscal and monetary policy measures to over R800 billion.”

As part of its contribution to ensure the smooth functioning of financial markets, the Reserve Bank has injected liquidity by slashing the repo rate by 200 basis points, and during April bought government bonds to the value of R11.4 billion.

Deputy Finance Minister David Masondo previously shared views that he would not be opposed to the Reserve Bank buying government bonds directly, as opposed to from the secondary market as a means to support Covid-19 measures as well as structural reforms for growth.

Reserve Bank Governor Lesetja Kganyago, however, has stressed that bond buying is strictly to address dysfunctionalities in markets. Kganyago has also said that the bank would come to the party to support the SA economy, by using its tools when appropriate and in line with the bank’s mandate, Fin24 previously reported.

The Reserve Bank has also relaxed regulatory requirements for banks to extend more loans. This could potentially release R540 billion into the economy, Business Insider reported.