MONEY CLINIC: How to avoid late joiner penalties on your medical scheme

With the high cost of medical scheme cover being unaffordable for many South Africans, many people will only feel the need to buy cover in the event of ill health or when they reach an older age. Delaying this grudge purchase can lead to additional expense.

This is according to Alexander Forbes Health Branch Manager, Sandy van Dijl.

“While there is no legislation in South Africa making medical scheme cover mandatory, it is important for members to understand the financial implication of only joining a medical scheme later in life, or at a particular time of need,” says van Dijl.

The Medical Schemes Act No 131 of 1998, allows medical schemes to apply late-joiner penalties where members join a medical scheme after the age of 35 or where members have had a break in cover for more than three months.

This is who medical schemes would consider a late-joiner applicant:

- The applicant is 35 years and older, and

- Was not a member or a dependent of a registered South African medical scheme on or before 1 April 2001. It is important to remember that cover outside of South Africa is not accepted as previous medical scheme cover.

- Has allowed a break in membership of a registered South African medical scheme of more than three consecutive months since 1 April 2001.

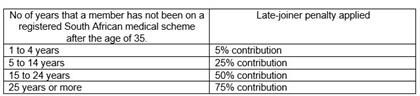

According to van Dijl, the late-joiner penalty is calculated taking into consideration the number of years the member had medical scheme cover with a registered South African medical scheme since the age of 35.

This penalty (known as a late-joiner penalty) is added onto the monthly contribution and remains with the member for life. It is important to note that any cover the member may have had under the age of 21 is excluded.

The penalty is applied based on the risk contribution payable to the medical scheme. This penalty is not applied to any savings component of the medical scheme.

How is a late-joiner penalty calculated?

The formula used to calculate the late-joiner penalty is the member’s current age (on date of registration) minus 35 plus the number of years of previous cover with a registered South African medical scheme.

Example: Age of the member on the date of registration is 58 years old. This member had previously belonged to a registered South Africa medical scheme for 12 years. 58 – (35+12) = 11 years without registered medical scheme cover. Therefore, the late, joiner penalty that will be applied to this member will be 25{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}. Refer to the above table.

How does one avoid these late joiner penalties?

“Members should try and avoid only buying medical scheme cover when they are older or when they need it,” cautions van Dijl.

- It is important to have medical scheme cover in place not only when the need arises, but to ensure that members have made provision for severe medical conditions.

The cost of treatment for any severe illness or medical emergency can be very costly and may mean further financial strain on families.

- It is important that if a member has had previous medical scheme cover with a registered South African medical scheme, that you keep a copy of previous membership certificate(s),” says van Dijl. These certificates can be used as proof of previous cover.

This is particularly important when changing medical schemes and/or changing employment etc. The medical scheme membership certificate provides important information relating to the member’s membership like the date that membership commenced, when the membership was terminated and so on.

If members have not kept records of their previous medical scheme cover, most medical schemes will allow members to submit a declaration of previous membership and/or submit an affidavit confirming that previous medical scheme cover was in place, prior to joining.

- It is important to at least be able to state in the declaration or affidavit the details of which medical scheme a member belonged to, together with the start and end dates of the particular membership. The more details that can be provided, the better the scheme will be able to access and accept previous medical scheme membership.

It is also important to note that if, at a later date, the affidavit is proved to be incorrect, the scheme may reject claims so members should ensure that they supply correct information.

If a member is not able to provide this proof of cover at the time of joining the medical scheme, late-joiner penalties may apply. However, if they are able to provide proof at a later stage, medical schemes will review the late-joiner penalty applied.

It is important however to note that there may be no refund due back to the member for the penalty applied, prior to proving previous medical scheme cover. The penalty is likely to be removed after the medical scheme has reviewed the proof of previous medical scheme cover provided by the member.

• Members must also be aware that hospital cash plans, insurance products, foreign medical cover and/or cover under the age of 21 are not recognised as previous medical scheme cover.

• It is important for members to consult their broker or financial adviser prior to joining a registered South African medical scheme so that they can be assisted with the calculation of the late-joiner penalty and fully understand the financial implications of such a penalty, should it be applicable.

Compiled by Allison Jeftha.

- Have a money problem that needs solving? Fin24 can help! Send your question to [email protected] or find the Money Clinic box on the right of our homepage.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.