The JSE rallied along with other global markets on Monday on

the back of positive sentiment that there were lower reported coronavirus related

deaths over the weekend from the main hotspots.

This gave some investors hope that this might be the first

sign of the virus leveling off as health experts and governments battle to

contain the virus. The local bourse started on the front foot as the positive

momentum from the Hang Seng and the Nikkei which rallied 2.21{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} and 4.24{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}

respectively, filtered through. The Shanghai Composite Index was closed for a

holiday.

Strong gains were recorded for all the major European

benchmarks as well as the US indices. Global sentiment remains mostly bearish

given weak economic data but any headlines on decreasing fatalities and monetary

stimulus could potentially lift stocks on a session by session basis.

On the currency market, the rand started the day well above

R19/$ as it reached a session low of R19.35/$. The weakness has been as a

result of the further downgrade of South Africa’s sovereign rating to two

notches below junk by Fitch ratings. However, the local unit found some

traction in the afternoon session as it pared all losses and ultimately

strengthened against the greenback. At 17:00, the rand was trading 1.79{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}

firmer at R18.69/$.

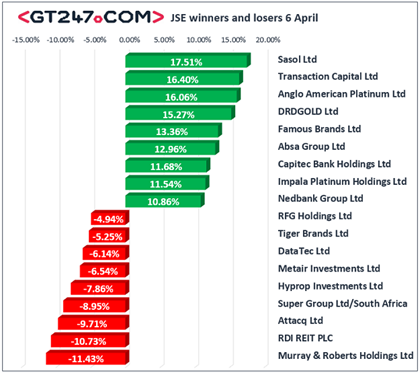

On the JSE, Sasol [JSE:SOL] managed to close amongst the

day’s biggest gainers after it advanced 17.51{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R46.65. Transaction

Capital [JSE:TCP] also rallied 16.4{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R14.55, while Famous Brands

[JSE:FBR] jumped 13.36{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R27.66. Although there were broad gains

recorded across all the major indices, the bulk of the day’s biggest movers

were from miners. Anglo American Platinum [JSE:AMS] surged 16.06{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to end the

day at R877.56, Impala Platinum [JSE:IMP] rocketed 11.54{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R87.00,

while Northam Platinum [JSE:NHM] gained 9.76{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R76.00. Commodity

trading giant Glencore [JSE:GLN] advanced 4.86{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R29.37, while

Sibanye Stillwater [JSE:SSW] closed at R25.43 after rising 9.9{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}. Significant

gains were also recorded for Nedbank [JSE:NED] which rose 10.86{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at

R91.58, as well as MTN Group [JSE:MTN] which closed at R51.70 after adding

9.42{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}.

Murray & Roberts [JSE:MUR] came under considerable

pressure on the day as it lost 11.43{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R5.58, while Super Group

[JSE:SPG] slumped 8.95{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at R11.70. Some listed property stocks

retreated as declines were recorded for RDI REIT [JSE:RPL] which dropped 10.73{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}

to close at R12.81, Hyprop Investments [JSE:HYP] which weakened by 7.86{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close

at R15.60, as well as Intu Properties [JSE:ITU] which lost 2.25{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} to close at

R0.87. Declines were also recorded for Tiger Brands [JSE:TBS] which fell 5.25{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}

to close at R178.00, as well as RFG Holdings [JSE:RFG] which closed at R15.02

after losing 4.94{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}.

The JSE All-Share index eventually closed 3.68{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} higher while

the blue-chip JSE Top-40 index gained 4.06{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}. The Resources index surged 5.01{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2}

while the industrials and financials advanced 2.65{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} and 5.63{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} respectively.

Brent crude started the week on the backfoot as it eased

from Friday’s highs. The commodity was trading 4.13{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} lower at $32.70/barrel

just after the JSE close.

At 17:00, palladium was down 1.28{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} at $2131.33/Oz, platinum was up 1.29{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} at $734.49/Oz, and gold was trading 1.7{e93887a69cdd95d753f466db084bbc3aa0067124675315461d28d68a72842cc2} higher at

$1645.86/Oz.

*Musa Makoni is a trading specialist at Purple Group

More Stories

Must-Know Business News to Stay Ahead in 2024

The Latest Business News Shaping the Global Market

How Business News Is Influencing Economic Growth